cares act stimulus check tax implications

As mentioned above the IRS will send out a check based on your 2018 or 2019 tax return but the stimulus check will actually be reconciled against your 2020 tax return. So how much are people going to be receiving for the direct economic impact payments included in the CARES Act.

How To Get Your Missed Stimulus Payments Nextadvisor With Time

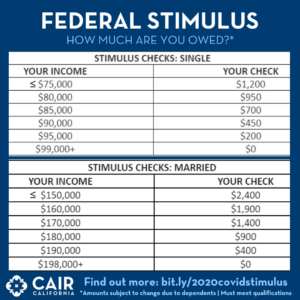

The amount of the stimulus check will be reduced or phased out for individuals whose income is between 75000 and 99000 with no checks issued for those making above.

. The CARES Act will have many implications for those who have already filed for bankruptcy and for those who are contemplating filing for bankruptcy. The CARES Act helps eligible employers by providing a refundable tax credit against payroll taxes equal to 50 percent of the first 10000 in qualified wages paid from. An EIP2 payment 23 de jun.

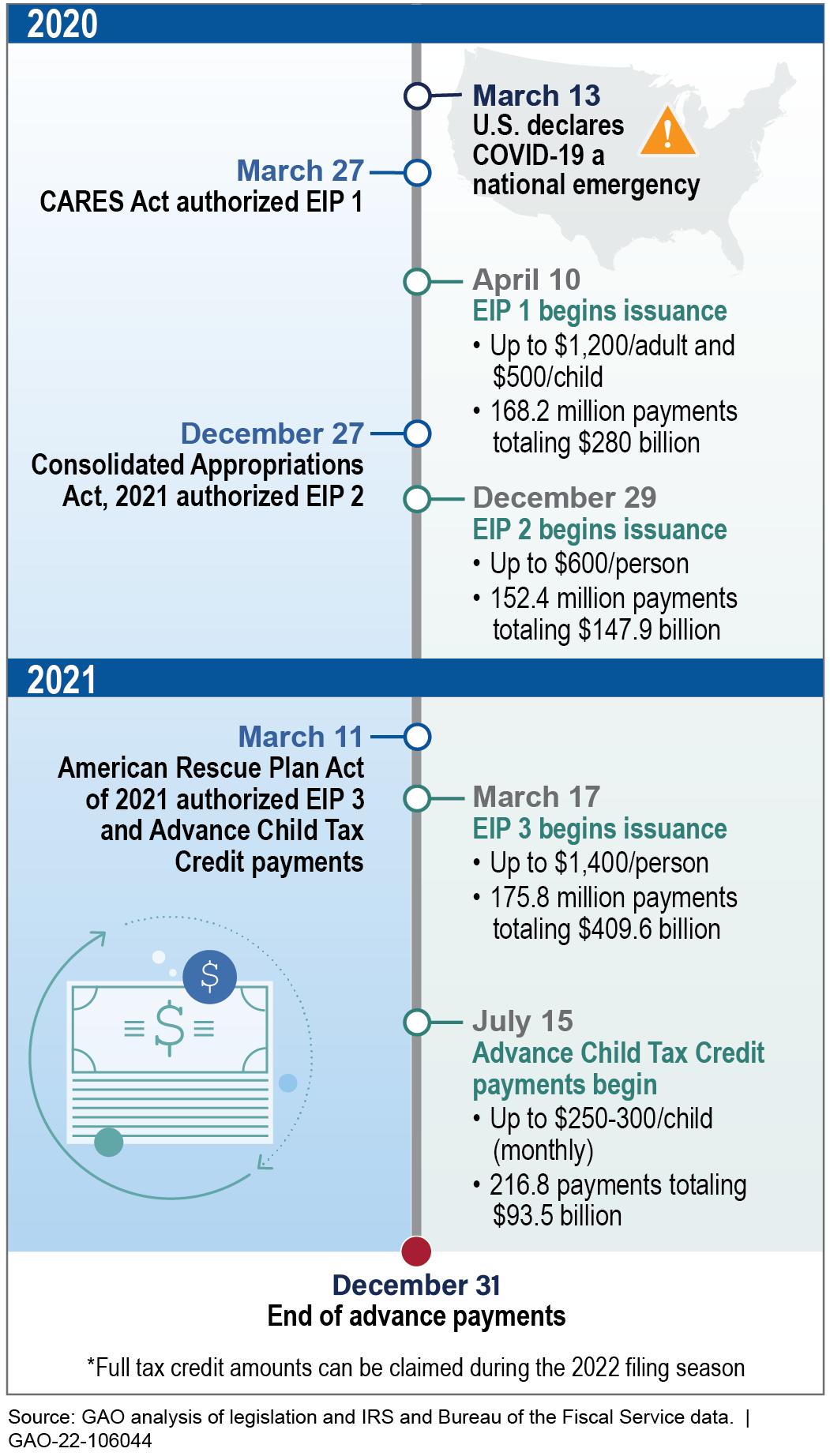

The most drastic changes were the inability for taxpayers to. The Tax Cuts and Jobs Act of 2017 TCJA changed how businesses utilize net operating losses NOLs. 1200 in April 2020.

Recent changes to the CARES Act resulting from the COVID-19 pandemic will have state and local tax implications for your business. The CARES Act passed in March created the first program that allowed companies to make tax-free contributions to their employees student debt and the new relief. If your 2021 income is lower than the 2019 or 2020.

Eligible individuals will receive checks in the amount of 1200 or less depending on adjusted gross income as reported on tax returns for either 2018 or 2019. But evaluating these tax impacts can be daunting. The CARES Act Stimulus is being offered to taxpayers for financial relief in light of COVID-19.

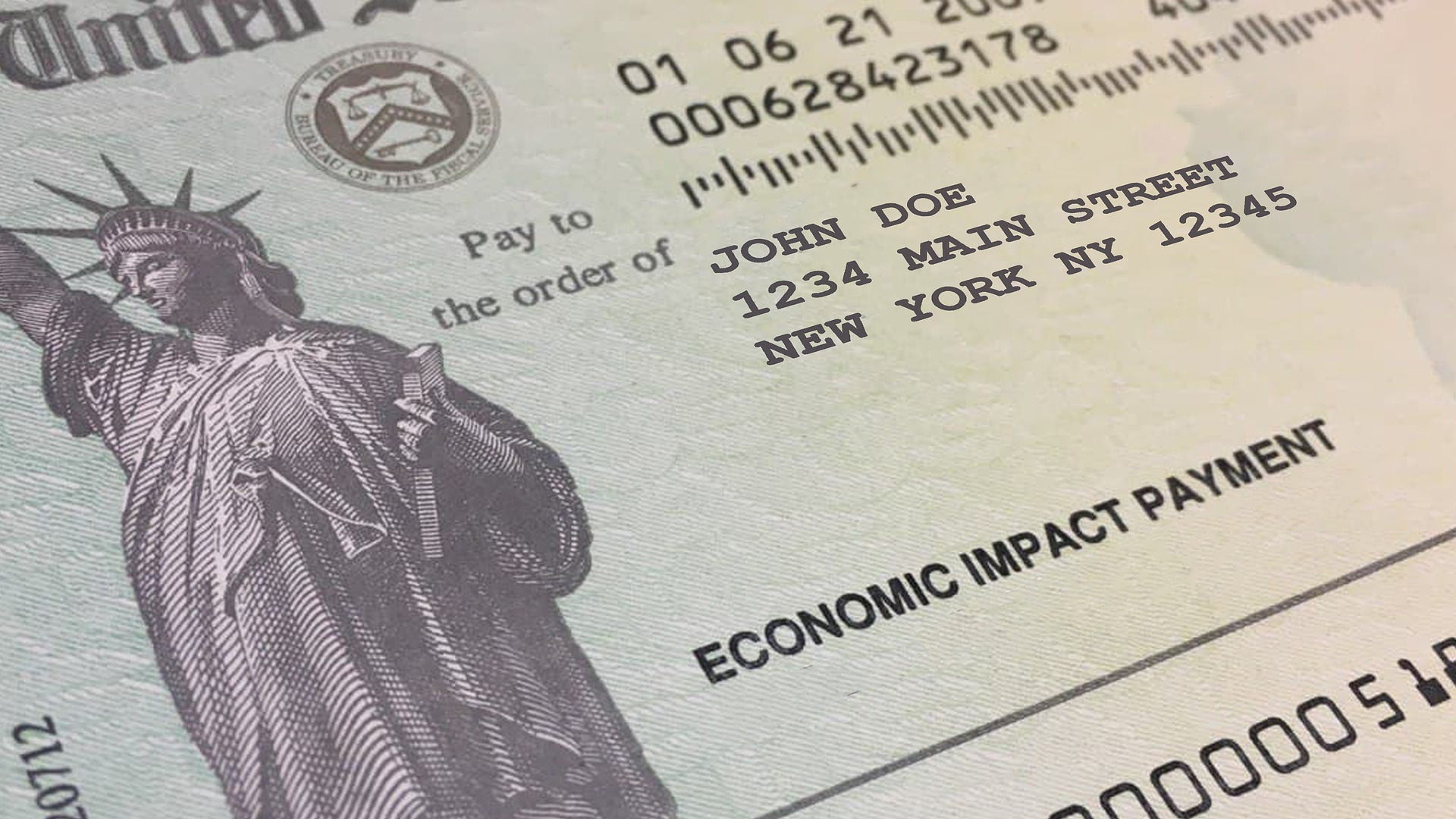

The CARES Act sends a 1200 stimulus check to eligible adults earning up to 75000. If your 2021 income is lower than the 2019 or 2020 income used to determine. COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Check out our Stimulus Check Calculator. This article will help you understand what that means for your small business taxes. According to an HR Block study of small business owners fewer than 1 in 3 28 are confident that they understand the.

The federal coronavirus aid relief and economic security act cares act consolidated appropriations act 2021 and american rescue plan act of 2021 contained a number of tax. CARES Act Provides Tax Incentives for Charitable Giving in 2020. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

Individual taxpayers will be receiving a 1200 payment. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

Reporting Cares Act Benefits On Taxes H R Block

A Guide To Covid 19 Economic Stimulus Relief Consumer Financial Protection Bureau

Why Haven T I Got My 1200 Stimulus Check From The Government Yet

Your Stimulus Check May Not Come Until 2021 The Washington Post

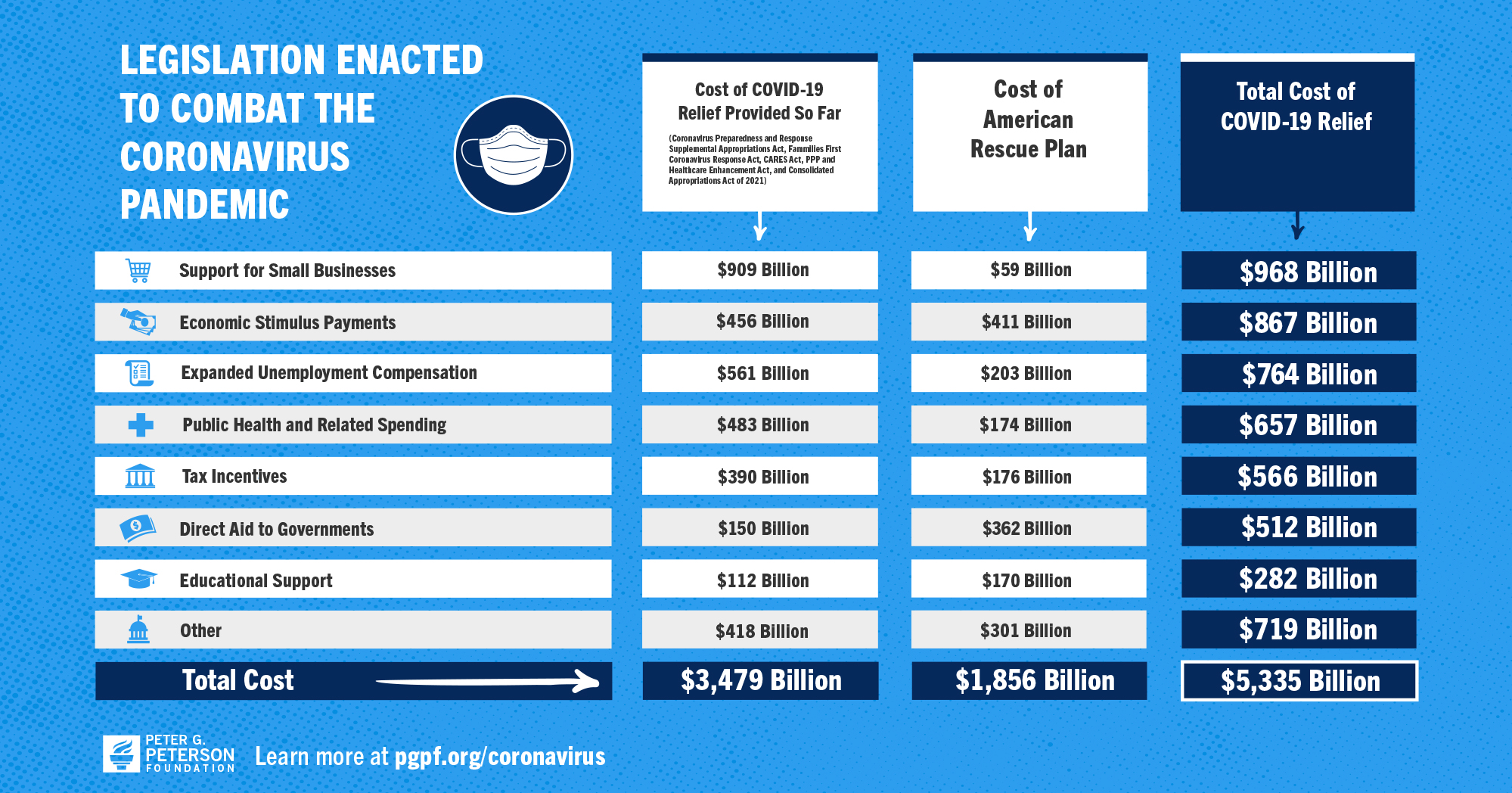

Here S Everything The Federal Government Has Done To Respond To The Coronavirus So Far

Prisons Are Skimming Chunks Of Cares Act Stimulus Checks

Still Missing Your Coronavirus Stimulus Check Here S What You Should Do Bankrate

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Coronavirus Tax Relief And Economic Impact Payments Internal Revenue Service

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

Covid 19 Economic Relief U S Department Of The Treasury

What To Know About The Third Stimulus Checks Get It Back

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

Ftc Warns That Assisted Living Communities Cannot Take Residents Stimulus Checks News Mcknight S Senior Living

Who Cares Assessing The Impact Of The Cares Act Frank Hawkins Kenan Institute Of Private Enterprise

Economic Impact Payments Irs Data Shows Who Benefited

Coronavirus Aid Relief And Economic Security Act Cares Act Council On American Islamic Relations

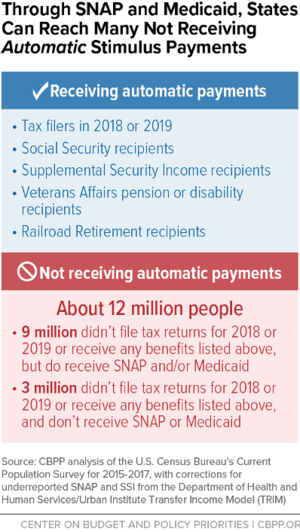

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities